A Strategic-Philosophical Meditation on Sovereignty, Wealth, and the Fate of Nations (Part 1)

Terms of Use: By accessing or using this website, its reports, or any Portellian materials, you agree that all intellectual property rights belong exclusively to Portellian Thoughts. You further agree not to copy, redistribute, commercialise, or otherwise exploit any Portellian content without explicit prior consent.

Portellian Thoughts reserves the exclusive right to define, publish, and adapt the Portellian doctrine, models, and frameworks.

——————————————————————————————————————————————

Table of Contents

Part 1:

1) The Currency of Sovereignty

2) The Moral Question: Fiat as Injustice, Gold as Justice

3) Menger’s Lesson on the Origins of Money and the Discipline of Reality

4) The Civilisational Stakes: Gold as Permanence and Truth

5) Historical Precedents for Small States on Gold

6) How a Maltese 100% Gold Standard Would Operate?

7) The Austrian-Nationalist-Libertarian Synthesis: Productive Sovereignty

8) The Maltese Middle Class Under Gold: A Lifestyle Secured

9) Family, Home, and Inheritance Under Gold: The Four-Child Household

10) Fiat + Cheap Labour + Property Speculation = Collapse of the National Standards of Living

11) Ending Cheap Labour Importation: A 100% Policy Toolkit

Part 2:

12) Demographic & Family Growth: Children’s Allowance as Statecraft

13) Narizny’s Grand-Strategic Frame: Monetary Discipline & Ruling Coalitions

14) The Human-Scale Economy: Schumacher’s Lesson for Malta

15) The Social Contract Under Gold

16) The Constitution of Money

17) Geo-Economics and Security: Malta as Niche Power

18) Resilience Under Crisis Scenarios

19) Against International Financial Institutions

20) Crisis Playbook & Drills

Part 3:

To be Continued

—————————————————————————————————————————————–

1. The Currency of Sovereignty

We must begin by asking a simple question, yet a very dangerous one indeed: “What is money to a nation?”

Is it merely a stamp on a piece of paper, a number that flickers across a digital screen, a mere convenience of exchange? Or maybe, is it something older, harder, more binding (a covenant of trust itself), the crystallised memory of work, the shared measure by which a populace keeps faith with itself across time? As Menger taught us, saleability precedes authority. Money arises not from decree, but from discovery — and sovereignty without monetary command is mimicry, a mask over dependency.

Carl Menger whispers to us an unromantic truth – Money is not invented by decree. It is discovered. It is a social institution that emerges because some goods are more saleable than others. Men and women, trading in the dust, noise, and chaos of markets, select the medium that travels best across hands and years. No parliament composed that melody; Civilisation learned it by ear. When I remember this, I see the first error of our age: mistaking political ink on a piece of paper for economic reality, and to call the edict “money”, while treating the market’s discovery as “primitive nostalgia”.

If money is discovered rather than manufactured, then the state that monopolises it, also monopolises the power to distort the very language by which prices speak. It violates not only prudence, but truth. Truth in weights, promises, exchange, and a nation that lives by these untruths in money will soon live by untruth in everything else.

I turned my eyes on my homeland, Malta. In 2004, we entered the European experimental project that was everything but European; in 2008 we surrendered our coin, thanks to Political manipulation and their art to deceive the entire population.

Since then, the ECB’s pen has been out metronome, our cycle, our weather. Hirschman would remind us here: dependency is leverage. The more asymmetric the ties, the more our pulse belongs to another’s hand.

I ask myself, “can a population remain sovereign when it no longer owns the unit that measures its labour, stores its savings, and preserves it’s value?”

We legislate in Valletta, but our money bows to Frankfurt, and Frankfurt to the international financial institutions. We vote here, but our balances rise and fall to the priorities and agendas of others. This is not a conspiracy theory at all! It is our very own structure itself, “protected” by puppets, and weaponized against us by the puppeteers.

We learn from Albert O. Hirschman, Edward Luttwak, Kathrine Barberie, and many others about such a structure.

In trade, supply, technology, and finance, dependency creates leverage. The one who controls the indispensable nodes of ports, pipeline, payment systems, currency, telecommunication, etc., – does not need to shout to command. He only needs to hesitate. A pause to clear our throats is faster than an order. Malta, joined by treaty to a currency we do not govern, lost a very strong currency in the process, and became dependent on the very organ that pumps value through our economy, depending on what they themselves value and not the other way around; and this includes the demands how they want our societies to evolve and become. We are vulnerable not only to policy but to policy’s priorities. These priorities are set by demographics, geopolitical diverging interest, mismanagement of funds allocation/s, coalitions, and crises far away from our shores.

But I ask myself, “Is this not the price of belonging into something artificial?”.

To answer this question, we need to wear the right lenses. I do not look through a progressive, socialistic, utopian lenses; but through Right-Nationalist-Libertarian lenses! Through those lenses, I see three claims that must stand together or not all:

Realism – A civilisation survives by order, hierarchy, and limits. By telling truth as it is, even when truth constrains. Morgenthau and Luttwak confirm this: realism is survival arithmetic, not moral fantasy.

Nationalist – A population is not a crowd. It is a continuity that bridges the past, present, and future, by race, ethnicity, blood, memory, territory, share genetic experiences, tongue, etc., striving to persist its survival.

Libertarian – Property and private action requires an honest measure. The state must protect the boundaries, not invade the ledger!

If these claims are real, then the question about currency is not technical, but rather, a civilisational one. A nation without monetary self-command becomes a tenant within its own house, where you can move your furniture, but you cannot move the walls or open a window.

The argument here is not to indulge in a romance towards autarky. Malta is small for that anyways; Malta needs to trade, or it will collapse. However, there is a striking difference between trading by choice and depending by necessity. The former is a handshake, while the latter is a leash. When external institutions have the power to dilute the unit that every Maltese family uses to save for a first home, feed their children, live in humane conditions, set aside for their pension plan, etc., when external priorities can cheapen the wages, while raising prices to the roof! I do not call this integration or progress, but rather, an abdication disguised as “sophistication”.

Therefore, here, the question deepens and bring fort the answer that money is a boundary. Not only a boundary between yesterday (work), today (wage), and tomorrow (savings), but between us and them (top decision making). The right to coin is the right to remember. The right to carry forward yesterday’s value to today and tomorrow, without asking permission. When that right is outsourced, the memory and unity of a population can get re-written by others (as we can current see and feel in our contemporary hostile environment that was once called our home). Prices wobble to cycles we did not choose or vote for; credit tides wash in and out according to storms we did not form; our youths read these tides and quietly leave. Sovereignty does not always fall with a crash. Sometimes, it drains away interest-free basis point. A point at a time.

I ask myself, “Is there no safety in this scale?”

Hirschman, Barberie and others, argue that asymmetry matters more than size. The small may be secure when interdependency is balanced. It is insecure when the terms of interdependence are set elsewhere.

In a multipolar world, money is not neutral plumbing – it is a statecraft. Sanctions, payment rails, settlement protocols etc., are all levers. Those who own the levers do not need to debate our laws or our people to shape our lives; they simple impose, and all they need is simple adjust the misery through friction on our transactions.

Another question arises here, “What is Sovereign money for a small nation?”

It’s not a license to print money out of thin air in a delusional manner at home! It is not a toy for demagogues. It is a discipline we choose, by refusing to buy calm today by mortgaging tomorrow. It is insistence that the measure of our work will not be quietly thinned out to serve someone else’s political convenience. It is, in the simplest words – The right to keep faith!

Menger insists that money’s strength lies in what men already believe about its qualities. Durability, divisibility, recognisability, saleability, stores and preserves its value across time; and no these aren’t slogans, and it’s an insult if you think of them that way, as they are the properties of money itself! The same money that you sell your time for, and through it, you survive life itself. When a state ties its unit to what civilisation already trusts, it submits to reality in order to protect its people and its interests. When it cuts the tie and call the cut “modernity, progress, some sort of divine blessing from God himself” etc., it elevates will over truth, and sends the cost bill to savers, families, and the unborn.

I am said to be old-fashioned by the pro-inflationists, but maybe, families are old fashioned too. So is inheritance! So is the production/ servicing of valuable good/ services! So, yes, the idea that a contract is made in good money, both should still make sense twenty years later. Right-Nationalist-Libertarianism demands that we defend both our borders, but also our free people; both depend on a stable measure. Without such stability, the border leaks capital, and freedom shrinks to the equivalence of the guess of next month’s prices (as you can witness all around us).

Here, I do not seek to decide on a model, but rather to set some terms. Our problem is not whether money should be “independent” in an abstract sense. Our problem is whether Malta can survive and remains Malta when its life is dependable on someone else conveniences. A sovereign nation may choose alliances, anchor, parity, etc., yes., and choose it must, however, if it cannot choose, it is not a nation. It just a mere term used to deceit the population, a pawn in someone else’s chessboard.

To answer the original question in simple language, money is the nerve of sovereignty. Lose it, and you become paralyzed. It is the instrument by which a population stores and preserves its past, prices its present, and purchases it future. To misgovern it is to lie to the deceived and the manipulated; to outsource such a vital element to you nation and people sustenance without safeguards is to forget. We shall not forget an important element in human history. And we should not ask families to build houses and a future within the nation, businesses to plan, or children to hope on a medium of exchange that melts in silent obedience to political and institutional abuse/s.

We will trade and we will cooperate, but we shall not do so commanded through our coin. This shall be the beginning wisdom for very small nation. Hence, why it must be the currency of our sovereignty. Anchored in reality, guarded by law, and beyond the reach of fashionable ruin by political incompetence.

2. The Moral Question: Fiat as Injustice, Gold as Justice

Here, we must face the moral weight of money, since money is never neutral. Is it either a covenant justice or a machine used for quiet theft! And by now, we all are used to, to the point that it became dangerously normalised for the engines to roar, while everyone pretends that they don’t hear it!

We obviously cannot say that we were not warned by Hayek, Mises, Rothbard, and others, about the fact that fiat money is not wealth, it’s a mere dilution of wealth. Friedrich List had given it another dimension from his nationalistic spirit – when money is debased, the very foundations of productive sovereignty are corroded. Fiat is not merely too of a “monetary management”; it is a hidden tax without consent, it is an invisible shackle around our ankles that slows us every day, a siphon operated by the political class against the hardworking producing citizens. A weapon used by bankers to enslave the population by means of debts and inflation. Hayek warned that the ‘denationalisation of money’ was not liberal eccentricity, but the restoration of justice against manipulation.

You have to think of this from your everyday life – a middleclass family that saves diligently monthly, the small business owner and the sole trader that lives next door, all the craftsman that you know from your town, none of them can access the freshly minted credits that pours from central banks. That privilege belongs to those closest to the spigot – governments, financial institutions, wars, pharma, and other politically connected corporations. By the time new money tickles down to the population, prices would have adjusted significantly upwards, and we must pay the cost for the credit money used and enjoyed by such industries. The savers in fiat buys less bread, the worker’s wage is not sufficient anymore – it buys less shelter, less food, less culture, less offsprings, less education, less medicine; the pensioner’s reserve evaporates quietly into thin air, as if they never saved anything before; forcing them back into the labour force to survive! This is not “stability”; this is a legalised expropriation!

As Rothbard puts its nicely in its exact nature “Inflation is theft”. Mises called it more seriously, a policy of deceit. But we can all agree that this is outright betrayal to the hardworking citizen by the very institutions meant to protect him. When the state debases money, it does not only weaken purchasing power; it severs the bond of trust between labour and reward. The message it whispers is corrosive: “Your efforts today only serve a master’ agenda and yours is worthless by tomorrow. Your prudence will not be honoured. Your sacrifice will not endure”.

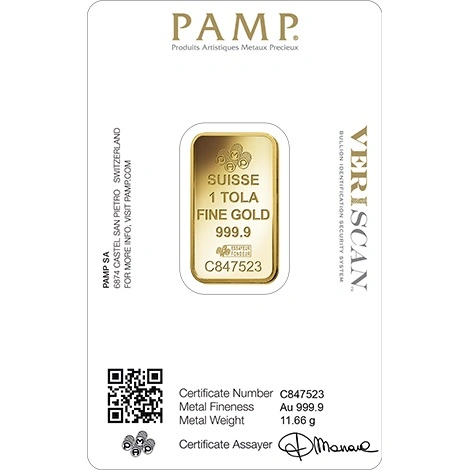

If we had to contrast this with gold, Gold does not make promises – it is by nature. A gram today is a gram tomorrow, irrespective of rhetoric or decree. Gold cannot be inflated by ministerial speeches or fiscal emergencies. It resists corruption in the same way it resists decay – it is nature’s refusal to bend to politics. That is why for centuries, people returned to gold – its not a superstition, but because it is the only monetary material that enforces honesty. As Rothbard sharpened it: inflation is not economics — it is theft by monopoly privilege.

We are also reminded by this by Buchanan and Jordan, that property rights mean nothing if the medium of property itself is unstable.

What is the right to own land if the loans floats on a currency that melts?

What is the right to save if the unit of saving can be manipulated away at will?

Justice in political economy begins with the integrity of the medium. Without it, all other rights are imagined fantasies. Buchanan was clear: property rights without stable money are castles built on sand.

This is where the lenses of Right-Nationalist-Libertarianism gives out clarity:

Realism because justice is not arbitrary. Thus, it requires a stable standard that does not change with moods.

Nationalist because people cannot survive if their labour and savings are drained year after year to subsidise outsiders or foreign interests or corporate priorities!

Libertarianism because true liberty cannot be possible if the fruit of one’s labour are silently confiscated through inflation.

If we take a look on certain local medias, they had reported that the median wages are around €1,200 – €1,500 a month, yet property prices for a modest apartment (excluding the ownership of the land and without privacy!) is pushed up to circa €280,000 and €300,000. Saving accounts earn you nothing, while the ECB quietly chips away of its value through inflationary policy. This is not a neutral inconvenience. This is structural injustice, created with the very blood of our economy.

The question we must ask now is “what does gold has to offer against this tide?”

The answer is, Gold offers loyalty and refuses to betray (even if mixed with copper or other metals or simply chipped – It will be known immediately at face value). What we earn, we keep. What we save is preserved and passed on. The weight cannot be betrayed and melted by parliamentary decree. It does not erode with a mere signature.

It tells people “Your labour is valuable and has a meaning. Your prudence has permanence. Your sacrifice will be honoured.”

When we defend gold, we are not defending a mere metal. We are defending the right of every citizen not to be defrauded by his own state. We are defending craftsmen, SMEs, and sole traders, who want their week’s efforts to hold its worth. We are defending families that saves up for a home without finding their saving diluted by political design when they are about to use it. We are defending the old couple that wish to pass on their patrimony without watching it being eaten away by an invisible hand, forcing them back to the labour force to make days-end meet.

Fiat is nothing more than the politics of illusion for self-enslavement. Gold is the politics of truth. Fiat robs you in silence, while gold stays true to its promise. All fiat knows is betrayal, all that gold understands is permanence and loyalty.

Therefore, the moral question here becomes quite obvious, “do we wish to be a people who quietly accept theft because it comes dressed as policy and free goodies – or do we wish to be a people who defend truth and value, even in coin?”

We can say that gold is the justice and property. It is the memory of a handshake that meant something. And if we wish to stand truly sovereign in the moral sense, and not just in diplomatic sense, it must start by refusing to steal from its own children through the deception of fiat.

3. Menger’s Lesson on the Origins of Money and the Discipline of Reality

We must now be honest with ourselves and ask a dangerous question, “what is money really?

As Menger had told us, money emerged spontaneously, naturally, because men and women in markets needed a medium of exchange that was durable, divisible, transportable, recognisable, a store of value, and preserves its value over a long period of time. They work, and because they worked, civilisation chose them, again and again, irrespective of how many forms of monetary experiments were conducted over millennia and failed. Hayek saw through this myth of ‘neutral money’: every injection alters relative prices and corrupts the structure of production.

This is the fundamental truth that we forget. Gold was not chosen by law; it was chosen by time. No one needed to be commanded to trust it. It became money because reality had revealed to men its qualities, and men respected what they could not counterfeit.

Then came the arrogance of modern fiat states because central banks and the money creators are behind them. Hayek warned us about this illusion that uses the myth of “neutral money”. As if a piece of printed paper, created out of thin air, can function as though it were the same as the commodity money that civilisation discovered. Money is never neutral and when states calls fiat “neutral”, it makes us ignore the fundamental fact that someone always benefits first – Politicians, banks, wars, pharma, insiders, close corporations, etc., while they milk the cow like there’s no tomorrow (receive money), by the time some of it falls to us, prices would have already risen and we start pay the cost for credit used by others.

This is why fiat currency is a dishonest currency, masked up as progress. Its promise decays, gold doesn’t. Selgin’s praxeology reinforces this: illusionary neutrality is an error — money’s integrity is axiom, not choice.

So, to answer our question; It is not a theory, nor an invention, nor a mere slogan for political manipulation. It is the most saleable good chosen by generations for millennia, and this good has been used for millennia to take mankind out of the monetary misery that they would have created themselves. To leave this for fiat is to exchange truth for illusion, permanence for decay, and memory for manipulation.

Money is not whatever the state declares upon us at gun point. Money is what civilisation recognise. And if we wish to remain within reality rather than sinking deeper into illusion, we must ground our lifeblood, our time, our energy, into something that endures, and not in the ink and lies of others.

4. The Civilisational Stakes: Gold as Permanence and Truth

Civilisations are like men, they need anchors. Without anchors, they drift away, tossed overboard by the storm, seduced by an allusion, intoxicated by the present moment until they forget the long chain of generations that binds them together. Some civilisation have anchored themselves in law, others in faith, others in language. But all of them shared one fundamental characteristic when they were at the peak of their heights – Their money was anchored to something beyond the reach of political abuse. So here, gold rises again because its the most enduring civilisational anchor ever known.

Why? Gold resists corruption. It doesn’t decay, nor rust, nor melts away in crisis or inflates itself to the winds of political rhetoric. A gram today, is a gram tomorrow, just as it was a gram in the days of our great-grandfathers. It did not require any speeches, or decrees, neither did it require any form of promise/s. Gold simply endures.

When Hayek reflected back on the gold standard, he saw that the downfall was not economic, but political. Governments passionately hate the gold standard not because it failed, but because it refuses to bow to their incompetence and serve them. Gold is more disciplined than all the states in all human existence put together! Gold refuse illusions and it’s the one anchor that tells Politicians the painful truth “You may not spend what you do not have. You cannot promise what you cannot deliver. You cannot send your peoples’ money out of your nation for International Political applauses. You may not debase reality to buy applauses and another term in power. You cannot engage in prolonged warfare and in large numbers. ” – And for this, it was casted aside. As Hayek put it: the gold standard was hated not because it failed, but because it denied rulers their narcotic of discretion.

For better clarity on the subject, the next question should be “What happens when money is no longer anchored in permanence?” – We see it and feel it everywhere around us. Fiat currency allows political fantasies – deficits without end, promises without costs, obligations without substance. It whispers to politicians that they may govern without sacrifice or responsibility, to bankers that they may lend without savings, to societies that may consume without producing. And yet, like every illusion, the truth will eventually re-asserts itself through inflation, debt slavery, destruction of the middle class, social depressions, and the slow corrosion of trust itself.

Gold demands the truth. Every expense must be matched by revenue, every debt by realistic repayment, every commitment by real capacity. It ties the hands of politicians, so that the hands of families may remain free. It forces nations to live within reality and in this, demand for truth lies not in weakness, but in civilisational strength.

If Malta were to tie its currency to gold, it would not be a romantic gesture, nor a return to some primitive nostalgic era. It would be a cultural statement that would say: “we Will not build our future on sand, we will not trade in illusion, we will not in-dept our children to buy today’s applause”. It would mean that we choose permanence over expediency, truth over fantasy, reality over rhetoric.

In a century where illusions multiply and paper promises crumble down, to anchor money in gold is to anchor your civilisation itself, to untie it is to cast generations into the sea without a keel.

5. Historical Precedents for Small States on Gold

If we listen closely to history, it whispers a power truth which is often ignore – Small States survive not through size, but through credibility. We do not command large armies. We do not have endless resources, however, in Malta’s case, our primary resource is our trades skills specialisations that will soon get extinct by political design to increase Malta’s dependency and forces the destruction of our organic society. What we have, or to lose, is trust. And the visibility of such trust is seen in money itself (hence, why they destroyed our trades skills to open the doors to cheap labour and dependency).

Lets start by looking at Switzerland first. Before, WW1, Switzerland had no empire, no ocean navy, no colonies. What it had was credibility. By anchoring its currency to gold, it cultivated a reputation for soundness, stability. Even when bankers and financiers, financed the destruction of old Europe, Switzerland stood as a safe have. Capital flowed because it was disciplined. Hirschman would call this asymmetry leveraged into security — trust itself became power.

Hong Kong is another interesting lesson. While its system was not based on pure gold, it had a currency board tied to external anchors. Still however, this credibility allowed it to shield itself during regional crises. Investors, traders, and savers knew the rules would not be bent for political whim. Thus, during the era of instability, Hong Kong endured because it refused to counterfeit trust.

Liechtenstein is much small than our Malta, yet it still shows us the same law on a much smaller scale. It did not defend its sovereignty through force of arms, but by making itself a model of predictability. Fiscal discipline, legal clarity, and credibility were its armour. Size mattered less than trust.

Let’s now look at Singapore. A small island, vulnerable on every map, but possess an iron clad Will to not drown in mediocrity. From its first independence day, it refused to be seduced by monetary populism. Its monetary authority chose discipline over applause. Stability was not an accident; it was the founding foundations upon which growth became possible. Today, Singapore is giant due to its credibility. Luttwak’s warning against turbo-capitalism fits here: discipline protects small states from volatility.

The pattern is unmistakable. Small states survive and prosper by anchoring themselves in truth. They understand what Kevin Narizny points out in his grand strategic framework that the survival of a ruling coalition depends on aligning its fate with the productive capacity of the nation. When elites tie themselves to stability, they endure. When they gamble with illusion, they fall.

In turbo-capitalism, Edward Luttwak warnings are still very much relevant here. In a world of volatile global flows, speculation, and sudden capital strikes, the small state cannot compete by scale. It competes by credibility. The nation that cannot be bribed by cheap money, the economy that cannot be swayed by speculative madness or perpetual governance, the currency that cannot be diluted by panic and/or emergencies, are the nations that survives.

From here, Malta can learn that gold is not nostalgia, but rather a precedent. It is a proven shield of small states that anchors their fate in credibility rather than illusions. In a century of turmoil, Malta will not survive by pretending to be larger than it is. Narizny reminds us: coalitions tied to stability endure; coalitions bound to illusion decay

6. How a Maltese 100% Gold Standard Would Operate?

Of course, we can perverse on the abstract of Maltese 100% Gold Standard, but such a question will be incomplete without asking: how would this system work in practice?

This question must be answered plainly, as sovereignty without architecture is only philosophical. A small nation like Malta is in desperate need for philosophers (such job is stolen by lobbyists), but such questions must move forward from mere philosophy to move our nation forward; We need discipline meeting reality.

We must first discuss its Unit and parity – The Maltese lira must be defined in grams of fine gold and not in shifting the shadows of another Euro, Dollar, or Sterling. A weight that carried faith, not mere promises. Parity will be lock into the constitution itself, changeable only by a national referendum, supermajority, and who suggests it, will bare a full-life long responsibility! No government, no parliament, no crisis or emergency decree can tamper with it! Only a constitutional supermajority plus referendum may alter parity, and whoever proposes it bears lifelong political liability.

This is the first line of defence: Sovereign definition itself!

Now we must turn around eyes on, on reserves – A 100% gold backing without compromise! Every banknote, every cent deposited, every unit in circulation must be backed gram for gram by gold in the vaults. No fractional illusions, no maturity mismatches disguised as liquidity. George Selgins’s insistence on Austrian Rigor – Praxeology applied to banking, will teach us that if money is to be trusted, it must not rely on political fictions. Selgin reminds us: if money is to be trusted, it must never rely on fractional illusions. Maltese banks would hold gold as custodians, not as magicians. Payments banks would move gold-backed units; investment banks would intermediate only time deposits, with maturities strictly matched. If you lend, you lend what you actually possess at the given moment in time.

At the third stage, we must enforce it as national defence. Debasement, double pledging, rehypothecation, credit expansion – these actions will not long be considered as technical violations, but rather, a threat to our national security itself! As truthfully they are! A nation that allows his money to be corrupted, allows its sovereignty to be hollowed. Just as treason is punished with severity, monetary betrayal should be as equivalent! Discipline in this field is deterrence itself.

A triad is formed when binding architecture, reserves, and enforcement. An action of sovereignty itself! Malta cannot project military power across oceans (although, it can protect itself against anyone, including superpowers with its specific deterrent strategy – This will be discussed in later thoughts on this page); but it can project itself as a credibility, small Nation across generations.

Credibility rooted in the vaults, becomes the quietest, yet strongest form of national defence! Debasement is not a technicality; it is treason in slow motion, and must be punished as such.

7. The Austrian-Nationalist-Libertarian Synthesis: Productive Sovereignty

Now it time for the Portellian thought mixture that binds different thoughts into a single doctrine of survival.

The Austrians thought us that when credit is cheap, production is distorted. Artificially low interest rates do not stimulate prosperity – they mismanage it and misdirect it. This forces capital to be drag into the realm of speculation to appease short-term projects; this will turn finance, property, resources etc., into a bubble that will collapse under their own deadweight (illusion). Mises thought us that the boom is not real growth, its just a mere seed of the bust. Hayek sharpened his arguments and thought us that when the price of credit is falsified, the structure of production itself is bent out of shape (post-elastic limit). And the middle class wages and savings will not be able to keep up, as a result, they will become the silent victims of this monetary intoxication. Mises exposed the boom as a seed of bust; Hayek showed how falsified credit bends the production structure until it snaps.

While List’s teachings were written in a completely different age, core concepts are even more relevant in our contemporary, and he did offer us a path, as a antidote against the Fiat madness! A nation’s sovereignty lies not in the endless borrowing of foreign capital, but rather, in the cultivation of its domestic productive power! It is factories and workshops, apprenticeships and skills, farms and ships, the secure independence. Import are not evil in their own nature, but dependency is suicidal. True wealth is not the pile of paper claims but the capacity to produce, to feed oneself, to arm oneself, to sustain one’s population without begging 3rd parties for permission and/or assistance. For List, sovereignty meant productive independence — not debt as leash.

Now its time for survival. Its time for the Portellian balance. The small state must be strong, but only where it guards the nation’s existence – In defence, integrity of money, preservation of our identity (race & ethnicity as well) and worldview (as articulated by Wilhelm von Humboldt), defending and preserving our culture and language, shielding strategic sectors and labour that if lost, we will transform into a vassal. However, within the economy itself; our daily bread and butter, the works of the artisans and craftsmen, the risks of entrepreneurs, the protection from collapse of specific industries, etc. – The State must be restrained! It must not suffocate us with bureaucracy, distortion of the market under fiat illusion, or distorts the labour market and its wages through importation of cheap labour and further distorts the market’s pricing signals due to the invasion to manipulate the market’s demand and supply!

The State must guard the walls and ONLY THE NATION BUILDS IT’S CITIES! Humboldt’s vision ties here: without culture and language, the nation’s economy becomes soulless calculation.

This is call “productive sovereignty”, where the savings of the middle class are preserved in honest money.

The entrepreneur, craftsmen, tradesmen, and sole-trader allocating capital without fear of inflationary theft.

The productive will be anchored in Maltese skills, expertise, soil, capital, and outlawing the endless importation of cheap labour or speculative growth to encourage consumption!

It is sovereignty build upon arithmetic.

In the end, sovereignty is not a merely a theory. It is the alignment of labour, security, savings, and production with the independence of the nation. Portellian thoughts seeks to teach about this crucial balance, which is not an ideology perse, its simply survival for a small nation given form.

8. The Maltese Middle Class Under Gold: A Lifestyle Secured

If anyone with good intentions wants to measure the real worth of a monetary system, prior-to delving into analysis, graphs, patterns, or ratios; one must first take a look at the property type and the kitchen table of the middle class. It is here, where the rhythms of wages, prices, savings, interest rates, rents, and loans, exposes the truth about money itself!

Under the fiat currency, it became the norm of every middle-class family to live in permanent insecurity, irrespective of how many hours they work. Wages rise slowly, on average, the average net wage is between €1,200 – €1,500 per month, while prices shoot higher. Every visit to the grocer is an exercise of disbelief in itself, exposing shrinkflation in portions and skimpflation in quality. The terraced houses and townhouse where once considered as the Maltese patrimony middle-class property type, but now, they are mere chips in a speculative casino orchestrated by our very own state – a two-bedroom apartment, worth roughly €280,000 without a garage, garden, spare rooms, roof, ownership of the land itself, a well, privacy, the real private property rights, decent national/regional architecture to identify yourself with; priced out Maltese middle class families, but not developers and landlords. Savings are milked by an invisible hand, as the bank account leaks value by the month! Under gold, homes cease to be speculative cages and return as vessels of patrimony.

All this misery, under the Gold Standard will no longer be possible and stability will find again its grounding. The purchasing power of money will be well preserved across years and decades! The skilled labourer can now be at ease that his work that he worked today will preserve its worth and value tomorrow. A salary will now not melt into thin air from within our very own pockets, prior-to taking out our wallets to pay for expense. Large families are now possible. Families can now plan their future with confidence, because now, prices will not require the manipulation from the State. They enjoy honest prices, as wages will be honest and very much real.

Property will once again regains its rightful place. It will no longer be speculative, inflated by cheap credit, built by cheap labour, developed by low quality materials, built fast with horrible, unaesthetically pleasing, globalist depressingly designed architecture to cut us off from our roots so non-locals can feel right at home, property sizes are getting smaller by each development, and finally, landownership to enjoy the real private property rights, and a roof to enjoy the Maltese landscape.

The Maltese patrimony homes will once again become Terraced and Townhouses – A true inheritance of stone, memory, nation, and kinship. The terrace and town houses will not be a collateral flip, but a proper dwelling to be held, improved, and passed on. Loans will be modest, with a flat fee and realistic short-mid plan to pay it off, rather than sheer debt enslavement for life by means of annual interests rates; grounded in real savings, not blown out of proportion by illusions. Repayment will be predictable, steady flat fee, ownership and real private properties secured, and liberty and privacy will reign once more.

In this order, the Middle class will grow and becomes strong again, because it will not be squeezed between inflation and speculation. The middle class will be liberated from such enslavement. Freed to save without fear, to invest without illusion, to raise children without the silent theft of inflation eating away the family’s future and prosperity. Under gold, the household balance sheet will become our first fortress of sovereignty.

For the middle-class, stability is not an abstraction. It is the difference between baring two children and four, between renting for life and owning a home, between being a part of your own organic national society and simply a mere taxpayer without loyalty to the nation and its organic national society, between scraping by and building wealth that endures. The gold standard is not merely an economic model, it is the restoration of a human lifestyle secured, a patrimony defended. In this way, the household balance sheet becomes the first fortress of sovereignty.

9. Family, Home, and Inheritance Under Gold: The Four-Child Household

Money is the lifeblood of a nation, but the family, it’s the beating heart of the Nation itself. And if our Malta is to survive and stay true to its roots, not as a tourist brand, not as a tax haven, not as the land of the finance and gaming, but as the Maltese People, then, its obvious that the next question of money cannot be separated from family and inheritance.

Under the curse of fiat currency, every newborn, i.e. every born legacy of our continuation of who we are, is being felt like a financial risk. Young couples looks at their wages, rent, loans, soaring basic goods and services, national security, and schooling, and they become hesitate to act. One child is the most common, Two children – maybe?; perhaps three, if fortune similes upon the couple, but rarely four. And yet, the arithmetic of survival is merciless:

- One Child – The line ends.

- Two Children – They are a mere replacement of the parents, and even this is detrimental, when many remain childless.

- Three Children – A buffer zone to ethnic extinction, but still not security. As the third child, will be a compensation for those couples with only one child.

- Four Children – This is the minimum threshold to avoid extinction and reserve the artificial manmade decline of our people, where the nation begins to grow again. Four is the minimum because it offsets the demographic loss from childless couples and mortality drift.

Many will think and will believe that this is an ideology. But in reality, it has nearly nothing to do it with it. It’s simply demographic statecraft (Europeans are less than circa 680million people from a global population of 7.8billion. Only we Europeans are at a risk of racial extinction).

In here, we can now enter gold’s power to achieve stability. Under the gold standard, family budget becomes simpler and predictable. Savings keep their worth, loans remain stable, food and basic needs are not subject to state approved stealth theft by means of inflation. A single wage can cover all the essentials and needs, while a second wages, if the family chooses it, it becomes a choice and not a forced act of a desperate necessity! Stability now will transform childbearing from a risk into a national, racial, and ethnic duty; a responsibility to who we are!

Stability alone, however, is not enough, especially during the first periods of its implementation until the equilibrium is reached once more. Therefore, the state must reward indigenous Maltese who carry forward our civilisation. Thus, a progressive children’s allowance is now possible, designed as a national investment:

- One child: €3,000 per year (€250/month)

- Two children: €4,800 per year (€400/month)

- Three children: €7,200 per year (€600/month)

- Four children: €10,800 per year (€900/month)

Over and above money, we are humans, and it is our human right to grow our own children ourselves, NOT the childcare centre and definitely NOT THE STATE!

Therefore, a two full years of maternity leave must be granted to the parents (they can choose who and how they will split them), so they can raise their child with their own hands, in their home, not in the shadows of a day-care necessity or financial panic.

Our property will also regain its meaning. Under fiat, homes became an object of speculation, a mere commodity stripped of intimacy, size, comfort, private property rights, privacy, land, and more! Simply, small cages big enough to sleep, eat, wash, and go quickly to contribute to the precious economy the next day! The very same system that enslaved us and destroyed our home and society!

Under gold, properties will return to their rightful form: patrimony! The terrace or townhouse will no longer be a merely building, but a vessel of inheritance – an identity echoing our very own national social soul – stone and soil, memory and pride. All passed down intact and loyal to our roots from one generation to the next. A real inheritance, not a debt-ridden illusion.

Thus, emerges the four-child family household – steady and stable budget, proud in their home, confident in their savings and future within the nation itself. This is not Utopia – as many of you were lucky enough to live under this system! It only fell in 1971, when Nixon wanted to go to war and he had to remove the Bretton Woods agreement. Thus, this is arithmetic – survival made possible by honest money.

In this model lies Malta’s fate. We either restore our organic family nucleus of nationhood, or we will simply get vanished into the statistics of extinction. As Wilhem von Humboldt observed, “the inner form of a language … reflects the manner in which a particular body of men regards the world about them” (On Language: On the Diversity of Human Language Construction and its Influence on the Mental Development of the Human Species. 1999 [1836], p. 60). Once that form perishes, the worldview of the people cannot be revived by words alone.

And here lies the truth: when a nation’s worldview is extinguished, when its family hearths fall silent, there is no resurrection—not in a hundred years, not in a million hells. What dies is not only speech, but the very soul of the national populace. Hence, why the national social soul must be defended by any means deemed necessary to ensure our continuation of who we are. Humboldt’s truth is plain: when the worldview of a people dies, it cannot be revived by slogans. Gold gives families the permanence to resist that death.

10. Fiat + Cheap Labour + Property Speculation = Collapse of the National Standards of Living

Fiat currency is an illusion. Its equivalent, or more likely, its twin, is cheap labour. They walk hand-in-hand, feeding each other, disguising decline as “growth”! Fiat prints money, cheap labour supplies bodies, and property speculation coverts both into mere deceptive figures designed to manipulate the untrained masses, by giving them the impression that looks like prosperity, but taste like extinction of who they are and the collapse of their nation!

Let’s look at Malta’s GDP. But first, what is this word GDP that is constantly used and tossed around by politicians?! This is dependency economics masquerading as growth — a mirage that counts heads but ignores hearths.

GDP is the grand total of the nation’s finished goods and services, expressed in money. It is the arithmetic of what a society has produced to meet its wants and needs, before questions of justice, morality, or sustainability are even asked. In a nutshell, GDP is basically the total value of all the final goods and services a country produces in a period of time. Taxes are part of those values, but GDP is about production itself, not just what government collects.

So, look at the GDP of Malta. Is it rising? Yes, but on what foundations is it rising? On the annual importation of thousands upon thousands of third-country nationalists per year, flooding sectors from health care to construction, to hospitality, to clerical work, to tradesmen, to IT, you name it! Forcing our people to flee for a better life. Such action itself, is an action of a cold genocide being committed on us basically! Hence, why this is not a strategy at all! This is purely demographic replacement masked as economic growth! Politicians boast about their expansion with their partisan incompetent voter base, while the streets whisper the truth – Wages are stagnated, housing costs are hyperinflated and unrealistic, and our youths, our future, our lifeblood – are force to flee their only home in search of dignity, decency, a home, and a life abroad. Malta is losing thousands upon thousands of it’s real young heirs, not through war, not through famine, but through the environment created by our own state’s policies, designed specifically to replace us (the mundus operandi of their fantasy economy model proves this in action) that quietly, he filled their hearths with hopelessness, by pricing them out of their own homeland. Again, there is not actual physical force at play, just indirect force. Hence, why it falls into the category of a cold genocide!

Both cheap labour and fiat currency had mastered the art of deception. The state rapes the printing machine or “borrows” to indirectly force the population to consume; employers with the blessing of the state, imports thousands upon thousands of cheap labour to further force the suppression of wages and decent employment positions. Developers sees the artificial population growth of TCNs, as an opportunity to exploits the moment – inflate prices of cheap, valueless, unaesthetically pleasing architecture without identity and barely enough space to fit a family of four, to accommodate more people to serve the holy economy, and further shrinks the housing cages to fit more cages!

Two-bedroom apartment of somewhere between 80 – 120 sqm2 sells at €280,000 – €300,000. These prices for young couples that earn €1,200 – €1,500, its called life conditioned and imprisonment for life, however, many will never be able to afford these little cages with enough space to sleep, wash, eat, and leave to serve the holly economy, as programmed by our own State. The State himself had ensured that the Maltese will be conditioned on how many children they can bare, by forming such an environment for them to achieve such restrictions without stinking with the partisan crowd! A family home was once a birthright, but thankfully, our State had turned housing (homing) into a mere casino chip, because his allegiance is with his holly economy – his precious corporations, and against both the Nation and the People he is meant to serve.

From what’s discussed so far, as a repercussion of it, a third accomplice evolves – property speculation. The prices of our land are no longer priced by the hardworking, dignified Maltese families, but the arithmetic of how many units can be squeezed onto a site. They shrink the quality to multiply the quantity. Shrinkflation and skimpflation were once considered concepts that where reserved to groceries; fiat extended it to the roof above our heads.

Apartments are developed smaller and smaller, materials used the cheapest of the cheapest, facades – ensuring the mass social depressions and anxieties, while expecting to further soar prices higher, while pretending that such apartments will be valued as a huge Terraced House with at least 4 car garage from 10-years ago! Our State had transformed our only home on earth from a family and Maltese people focus to a never ending churn of speculation fuelled by our state to further import TCN and inflates credits. With severe repercussions on both the Nation and the Population.

The results, as we can already feel, see, and experience on a daily basis, the collapse of our standards of living. Our wages are diluted by importation of cheap labour. Our way of live becoming more slavish by the day! Homes are stripped of any forms of national aesthetics, let alone mere basic beauty, by speculative trends. The wrong pricing signal are constantly giving out the wrong market pricing signals, thanks to the constant government involvement in every aspect of our life (then they fool the idiots that we are democratic and free!). Our families are reduced in size by economic fear, while the new imported State’s version of DEI-Maltese populace, birth more and more of their own people, instead of us; while forcing our real blood to flee from this prison island, leaving behind a state sponsored and promoted agenda to get furthered geared in motion, to demographically replaced us in our own homeland with the full-fledged invasion of TCN annually!

Obviously, this is only possible under Fiat currency, as it enables it, while cheap labour sustains it, and property speculation profits from it, while aids to destroy the national soul. Together, they destroy the very meaning of a nation. Hence why the state is a pro-inflationist and must serve the agenda imposed on him by the creators of money itself!

This is by far more deeper than a mere economic system, as this is a slow motion act of civilisational vandalism at its finest – a cold genocide by spreadsheet, conducted not with armies, but with the invasion of TCN quotas (while the state itself signs contracts behind the populace back without an ounce of transparency or democracy, like a true professional communist at heart), bank loans, and cranes.

The Gold standard will destroy this unholy trinity without mercy! Honest money will end the illusion of fast, short-term growth, with constant increase in dependency. Employers will not longer be able to import cheap labour. The State and the market will be forced to invest in Maltese skills, while they will be forced to produce good quality goods or services, or they will easily go bankrupt. Properties will cease to inflate on speculative credits, while these newly built cages will be forced to deflate exponentially. Real savings will get stabilised. And the demographic survival will regain its place above demographic substitution.

Collapse is not inevitable, but only if we recognise its mechanics. Fiat, cheap labour, and speculation form the unholy trinity of decay, each sustains the other, together they destroy the nation.

11. Ending Cheap Labour Importation: A 100% Policy Toolkit

I am aware of the fact that in our contemporary, people criticise, yet they never offer a single decent remedy to what they are criticising. And a critique without remedy, in my opinion, its impotence. If both fiat and cheap labour erodes the nation, then sovereignty demands not only a diagnosis, but also the cure. Here I will sketch the Portellian Toolkit to 100% reorientate the labour policy towards dignity, sovereignty, stronger middle class, labour security, and demographic survival.

We must first start off by placing apprenticeships as the cornerstone. Any employer, local or foreign, large or small, who benefits from Maltese soil, must invest in Maltese skills and must employ Maltese and Europeans, or their industry will be forced to pay an additional 65% or 20% taxation per head (the former is applicable for TCN, while the latter is applicable for Mediterraneans), devoted from the employer side. Once this is cleared, no business will be allowed to expand its payroll without running an apprenticeship program or dual vocational training schemes. A mason, a carpenter, a shipbuilder, an engineer, you name it – each field must have an apprentice at his side, not an imported replacement of the Maltese people. Skill is by far more than just a mere labour. It is security! It is sovereignty embodied in human hands. Luttwak saw this global arbitrage clearly: workers reduced to casino chips, their loyalty auctioned abroad.

Secondly, we must target the wage floors and rising them above the median, but not the ceiling. If an employer lacks the necessary skills locally for a particular role, he must first search in Europe, and if that skill still lacks, then the law shall demand wages that are double the national median for that role, and secondly, he must train a local for that role in the process. Double-wage rule applies only for genuine skill shortages; not a licence for undercutting locals. If anyone imports cheap labour and pays wages lower than the Maltese to disrupt the market and pricing signals, a flat fine of €5 million will be applicable, and the business will be forced to be liquidated! – It must be dearer and it must kill their operations! This way, foreign labour can only enter to fill in real shortages, not to undercut our people to operate a business that without cheap labour the business wouldn’t even be operational. The globalist model of “labour arbitrage” – which Edward Luttwak warned us about, that turns our people into disposable units in a world casino, will be completely outlawed in Malta.

Thirdly, a full recall of all our blood, stolen by other nations for their own benefits at our expense! Our kins are not lost, nor forgotten. They are our sovereign wealth abroad that gained experiences and skill.

Therefore, Malta will craft policies that will bring them back:

- The currency will be backed by gold, and if they return and establish SMEs, Sole trading, Artisanal, workshops, agribusiness, technology/ defence industries, dual use technology firms etc., will be granted favourable flat fees on loans, while enjoying the first 10-years without paying the fee. This will be followed by the attainment of a shadow baking license after 5-years of operations, with applicable T&C.

- Ten-year property tax relief for those who return and occupy a home.

- Fast-track recognition of qualifications and skills, so their skills will be immediately deployed within our market.

- The State will also grant them procurement preference for returnee businesses, especially those within strategic and geo-strategic industries.

For us, the return of our blood is more than a mere statistics – each one of our blood returned means memory restored, blood reclaimed, a threat rewoven into the national fabric, and the recollection of our full national social soul. Hirschman’s logic of ‘exit vs voice’ demands this: we must turn Maltese exit into Maltese voice by recalling them home.

Labour sovereignty is the fourth principle. This has nothing to do with the liberal art of creating labels of something-phobia, simply because we do things arithmetically and not from their fantasy world. A nation of circa 350,000 indigenous populace cannot import over 20,000 TCN annually, while forcing by the thousands upon thousands the future of our nation to flee out of their homeland, by destroying their living standards, destroying their organic society and identity, keeping wages artificially low, distorts the housing market, distorts the market pricing signals, re-programming the populace worldview and way of life, while ensuring to enslave them by means of debts! Every permit for foreign labour is a political choice about who remains Maltese, who becomes marginalised, so they make enough room for their interpreted version of Maltese people. Sovereignty means refusing to disguise demographical collapse as economic growth!

The policy toolkit has to be blunt out of necessity:

- Tax penalties and higher taxations per head, devoted from the employer side, to firms dependent on cheap labour importation.

- Those firms that employs 100% Maltese and Europeans, they will benefit after 5-years from a granted shadow banking license to give out loans in gold to Maltese and European individuals only.

- A Tax relief for firms investing in automation, ghost industries, upskilling the Maltese, and employing 100% Maltese people.

- A national wage compression index, published annually, to monitor and punish deliberate wage suppression. (If an industry wants to operate by means of cheap labour that industry has no place within our market).

- Urban planning tied to Maltese and European demographics, not foreign invasion.

This is how sovereignty must be understood in the 21st Century. Not only at the border, but in the payslip. Not only in the army, but in the apprenticeship. Not only in defence policy, but in the wage packet of mason, artisan, tradesmen, the midwife etc.

A nation that abandons its labour security, abandons itself to stand on its own two-feet. The Portellian answer is simple: we will not! Sovereignty is not a slogan at the border; it is the dignity in a payslip and the skill in a craftsman’s hands.

——————————————————————————————————————————————

Part 2

12. Demographic & Family Growth: Children’s Allowance as Statecraft

If labour sovereignty guards the dignity of today, demographic sovereignty guards the survival of tomorrow. A nation can endure foreign debt, it can endure even invasions, but it cannot endure extinction by arithmetic. And Malta, like Europe, stands at the edge of this abyss. Five births a day, and if fortune smiles upon our nation, only one/two is/are Maltese, one/two is/are European, the rest third-country nationals. This is not by fate; it is by design. A deliberate act of demographic replacement statecraft imposed on us, using the language of economics as cover.

Here, Portellian Thought does not flinch. The family unit is sacred and not merely private, but the frontline of our civilisation. Raising children is not a lifestyle choice. It is an act of sovereignty, the most profound act of national defence. If the State is to be worthy of its name, it must recognise this, and not with slogans but with material action.

That is why we must sharpen the arithmetic: one child is extinction, two is stagnation, three is fragile survival, four is security. The four-child household is not utopia, it is the bare minimum of continuity. This is a survival formula.

But the formula alone is not enough. It must be backed by tools of economic statecraft. Inspired by David A. Baldwin reminds us that statecraft is not only coercion abroad, but the allocation of resources at home to shape our survival. Just as subsidies and fiscal policy can be used to favour corporations and lobbyists, so too can they be redirected to favour our birth rates, continuity, and the survival of our blood. That is why we say clearly: children are sovereign wealth.

The policy instruments must be blunt, unapologetic, and permanent:

The Progressive children’s allowance:

- One child — €3,000 annually (€250/month)

- Two children — €4,800 annually (€400/month)

- Three children — €7,200 annually (€600/month)

- Four children — €10,800 annually (€900/month)

Parental leave must also be taken into consideration. Two full years of paid maternity leave for Maltese and Maltese-European couples only, split as they choose, so that children are nurtured at home, and not outsourced from birth to strangers.

An eligibility restriction must also be in place. These allowance and assistance are for indigenous Maltese and Maltese-European kin only. They are not a welfare tool for imported demographics to ease off our replacement. Every allowance paid and every benefit taken to a Maltese and Maltese-European families must be tied to one less visa for cheap labour, and less corruption/ abuse from the businesses and the entire supply chain that brings them here. Birth will replace importation.

- Resource allocation: All subsidies for speculative industries, maintenance of non-essential governmental entities/ ministries, non-strategic immigration schemes, vanity projects, non-strategic governmental malinvestments, deadweight governmental institutional malinvestments, and the removal of governmental welfare abuse, so these funds must be diverted directly into the natalist fund. This is an OUR Civilisational budget, not a charity fund!

- Birth Rate linked to National Security: Every born child is a shield against our extinction, a rightful heir of our homeland, worldview, and memory; a producer, an entrepreneur, a philosopher, a defender, an artist of our tomorrow. Demographic vitality must be treated as what it actual is – A National Security doctrine, alongside sovereignty and defence.

As of this point onwards, natalism is no longer a sentimental topic and it becomes a statecraft. Our demographical survival must become institutionalised with the same seriousness as military readiness, or disease national security emergency control. If our navy protects our sea, our aircrafts protect our skies, then allowances and benefits protect our cradle of our civilisation. Both are national defence!

Malta 2040 – Two Futures mini-hypothesis.

If natalist statecraft succeeds: Malta in 2040 will become loud with children. Schools will be full of our future – not replacements, apprenticeships will start thriving, trades will get alive again, and there will be an outburst of SMEs, Entrepreneurs, and Sole traders from different fields. Improvisation and innovation will start to spike upwards. The four-child household will no longer remain a rare phenomenon, but rather a normalised norm again, through stabilised money through honest money, and supported by the nation itself. Skilled Maltese security through the return of our youths that once fled and our blood that fled to build other nations, will return, drawn by stability and pride, bringing with them their wealth, capital, and diverse expertise. Malta’s high Culture and high Politics will be on the ascend with numerous spillover effects. Malta is small, but sovereignty assured. It will be anchored by families that multiply, homes that endure, and skills that are reborn. We will become again a Nation with a future! A Nation with a long-term strategic vision.

If natalist statecraft fails: Malta in 2040 will be silent from its blood, but very loud with its replacements. Schools are shuttered, villages empty of its heirs, our worldview forgotten, and our language eroded, and if we are lucky, we will be remembered as the last generation. Bringing the absolute end to the Maltese civilisation. The Maltese will become too outnumbered within their our homeland that they won’t even be capable to pose a single threat to invaders, and they will live on their knees at the mercy of the invaders, until they perish; the Maltese folklore will become such a minority within its homeland that practicing it will pose a security risk to who practice it, while every single sector will be filled with cheap labour without loyalty to the nation, nor the people, nor to who we are. Likewise, the Maltese Parliament will be composed of mainly invaders, while keeping the Maltese two-party system, and they will decide themselves for the Maltese indigenous people. All of the Maltese stone patrimony houses will be sold off and demolished to fully extinguish any traits or forms of Maltese identity; inheritance will be replaced by tenancy. The Nation will become a hotel, not a homeland. While the flag might remain the same, but flying it will be pointless without the real heirs of the nation to fill it, thus it will mark that the land belongs to others. This is sheer extinction by treason, incompetence, and negligence, a death by arithmetic, not fire.

These policies have a double-edged effect:

- They will strengthen the Maltese bloodline and genetic memory, ensuring ethnic survival across generations, reaching the target of a one million indigenous Maltese population, populating all of the Maltese Archipelago, and the four islands of 10km by 10km each.

- The middle-class dignity will be restored, and we will notice a spike in high cultured middle class, together with an increase of nationalised SMEs, Entrepreneurs, and Sole traders making up over 80% of the market, which will show that the nation’s values their sacrifice and continuity more than they value cheap labour invasion, cheap low quality materialism, and market dominations by geoeconomic means, thanks to the decisions taken by globalist politicians.

The facts are clear. If a nation fails to reproduce itself, it is not sovereign, it is only a tenant on borrowed time. Sovereignty without natalism is a flag without people. Under the gold standard and Portellian natalism, Malta will choose differently and will challenge the agenda that was imposed on us. We will multiply. We will endure. We will deport anyone that doesn’t belong here. And we will show that demographic policy, when rooted in discipline, is one of the highest forms of economic statecraft.

13. Narizny’s Grand-Strategic Frame: Monetary Discipline & Ruling Coalitions

Kevin Narizny explains to us that the Grand Strategy of every nation is not written in clouds or idealism, but rather, it is written in hard ledger of its ruling coalitions, the real puppeteers that decides survival to the average populace. These elitest rule by preserving themselves and they craft policies through their puppet politicians for the good of the coalition, not for the nation or the people!

In Malta, our coalition is pitifully narrow: A revolving case of specific ideological politicians, specific developers, obviously specific bankers and financiers, and party specific loyalists that orbits around the axis of patronage. Yet, all these coalitions now bow proudly to foreign power and influence! So, what’s the interest of the members of the coalition under fiat? Ensuring to keep the illusion and speculations alive! Print more, borrow more, build more, import more, and ensuring to further skyrocket the national debts as a whole! Until mankind fully forgets what it means to be human. Fiat Fuel cheap credit, cheap credit fuels speculative construction, speculative construction demands imported labour, and imported labour props up the fantasy of prosperity. The coalition survives, while the nation and the civilization dissolves.

Such survival logic, as interpreted by Narizny, is when the coalitions bend the economy to ensure their own continuity. And under fiat, their survival is cheap and its paid by the populace. They can mortgage tomorrow for applause today, but when the bill arrives, it will be too late for accountability, and the future generations will inherit unsustainable debts, which automatically makes them slaves for the system immediate from birth!

Under the gold standard, the calculus breaks. No coalition can inflate itself to popularity. No minister can conjure prosperity with debts and illusions. No developer can endlessly stack cages of concrete in every piece of land/ property that they can get their hands on, upon illusions of credit. Gold enforces reality – Every promise must be weighed, and every cost must be paid.

This is where Portellian Thoughts sharpens Narizny’s insights. Gold is discipline, not merely restraint. It forces the necessary evil of coalition to align with the nation’s and civilizational survival. If we deprive them of endless credits or migrants, they will be forced to build time with productivity, labour, and endurance. Which will stabilize our way of life in the process. Grand Strategy, now, it becomes a political permanence.

In Economics Statecraft, we are reminded by David A. Baldwin that power is not only coercion, but the ability to resist coercion. So the same principle can be applies here, gold immunises the coalition from its own worst temptation – buying time through the manipulation of the fiat’s value and purchasing power. It will shackle any leader that tries to sell our sovereignty for temporary applauses and in doing so, it will transform calculus itself.

Mini Scenario: Coalition Under Fiat vs Coalition Under Gold

Malta by Fiat: The survival of the coalition by expansion is through submitting to foreign control by credit, by expand by deficits, migration inflow, construction-financial bubbles, and other forms of bubbles. The middle class is bled dry, youth flee for a better life, property is inflated-shrinkflated-and-skimpflated, and wages collapse/stagnate. The nation decays slowly, so the coalition can survive, until finally the ruins that they’ve created would consume them.

Malta by Gold: The coalition is of Maltese origins and bases its survival on discipline and on the national worldview. Their power grows stronger in the longer by nurturing local skills and expertise, stabilize wages, increases the overall improvisations good/s and service/s, and investing in long-term sectors. Through gold, expenditure must first be saved before spent and promises that they cannot deliver will no longer deceive. This way, coalition survives by ensuring the survival of the nation and the civilisation.

So Malta’s Grand Strategy must be sovereignty that is anchored in survival, not speculation, in gold reality, but not in the fiat illusion. Monetary discipline is more than the economics realm that are visible to the eye; it is also statecraft, coalition-checkmate, and civilisation endurance.

In its clarity, Narizny was brutally clear – grand strategy is not born of ideals, but of coalitional bargains. The foreign policy of a state is the reflection of who pays the bills and who cashes the benefits. Industrial coalitions produce protectionism, financial coalitions demand openness, military coalitions demand expansion. Strategy, in his worldview is not seen as “the national interest”, but rather, the survival of the ruling elitists that are in power.

As we’ve seen in Malta’s ruling coalitions, they are financial, and construction driven. Thus, their grand strategy its like an inward parasite – it prioritises endless property speculation, cheap labour pipelines, cheap low-quality materialistic goods/ services, and European funding schemes. Defence, demographics, sovereignty, culture, worldview, language, etc., these do not matter to the coalitions, as they do not fund it. Therefore, the survival logic of the coalition makes our national strategy one of dependency, because they will profit from such dependency.

As Narizny had nicely showed us the ruling coalitions can be forced to realign when their illusionary instrument collapses. This is where gold will intervene to save us, by instilling discipline. Under a 100% gold standard, coalitions cannot inflate their way out of trouble or import bodies to feed their pyramid scheme. Now, they will be forced to embrace a national survival strategy, through long-term productivity, industrial capacity, labour and skill security, demographical vitality, and worldview survival for improvisations. In Narizny’s terms, the “survival calculus” of the ruling coalition is now chained to the survival calculus of the nation and the civilisation themselves.

Here’s the Portellian twist to Narizny: gold is not just economic discipline; it is grand strategic reconfiguration. The incentives of the ruling elites are diverted away from the parasite, towards national preservation. Their ambitions are shackled to the endurance of the populace. And here, monetary policy becomes more than just finance. It becomes the very architecture of Malta’s grand strategy.

14. The Human-Scale Economy: Schumacher’s Lesson for Malta

Schumacher had warned us that this gigantism that’s being worship in the modern age – bigger states, bigger governance, bigger corporations, bigger lies. However, by Malta’s its own nature, was not built for gigantism. We are too small, too human, too bound to soil and sea, and we are a very small island of 27km. So, copying the structures of continental giants is not only foolish, but a suicidal extinction.

Fiat economies worship gigantism because only giants can swallow the cheap credit that’s pouring from central bankers, and let’s not forget all those industries involved in any governmental perpetual activity/ies. Developers, franchises, financial conglomerates, war industries, etc. are the beasts that thrive on debts. The National valued ones like the artisan, the family shop, the sole trader, the entrepreneur, the SMEs? They suffocate. They struggle to stay afloat. Their savings evaporates into thin air, their labourers and their skills are undercut, they struggle to afford experience, their skill is reduced to a mere curiosity.

This order is turned around under gold. The Portellian gold system, growth cannot be a conjure figure on a piece of paper. Growth must be generated through real work, real money, real savings, real skills. This discipline restores the balance between man and economy.

This means that the tradesmen can pass on his workshop as a patrimony, not as a debt-ridden liability, or a dead trade struggling to stay afloat without the possibility of improvising the trade itself. He can now price his creation with confidence that tomorrow’s coin will not betray his efforts of today. He can now save properly and expand his workshop without begging for loans that dissolve in inflation.

This will restore humanity to economics. Parents will once again be able to earn honest side incomes from family ventures, artisanal skills, and small trades. An untaxed survival streams outside the suffocating grasps of the corporate state economy. Children will now not only be grounded in schools, but also in workshops and cultural related trades, learning generational trade skills that feeds and secures both their family and their nation. Skill secured will be cultivated national out of our flesh and blood, not eradicated and imported via dependency.

This is what Portellian Thoughts describes as a “Human Economy”. Pro-Nation, Pro-Family, Pro-People, Pro-Liberty. This not anti-growth at all, this is real growth from our roots. This is not anti-market, this the market restored to its natural size. This is an economy where freedom is measured not through how much credit one can borrows, but how many children a craftsmen can raise and culture on honest wages, how much dignity a family shop can preserve against foreign franchises, how many Maltese can remain Maltese through the work of their own hands.

In 2040, Malta under gigantism will be composed of strip malls at every corner run by imported brands and owner, apartments stacked like cages, youths enslaved to service jobs for outsiders. The nation survives only on a piece of meaningless paper. Nothing more.

Now if one imagines Malta in 2040 under the gold standard and utilising the human scale economy. Vineyards on terraced hills, numerous trades workshops around town, villages, and cities. Their goods are being exported, while there’s a healthy micro-economy. Family shops that endure for generations, skills improved and evolved over generations, Goods and Services are woven into our Maltese/ Mediterranean/ European guilds of trade. We will display a small nation in size, but vast in the national cultural soul – dignified, distinct, rooted, and Sovern.

In his work “small is beautiful” Schumacher was right. Small is indeed beautiful. But Malta will prove something more. It will prove survival and continuation. Gold makes this possible. Family makes it real. And together, they form the human-scale order where liberty, nation, and civilisation endure.

15. The Social Contract Under Gold

The survival of a nation is not held together by law and order alone, nor by armies, nor by a piece of paper that calls it “Sovern”. At the core for its survival lies trust. It is an invisible contract that binds rulers and the ruled, neighbour and neighbour, community, family and soil. Once that trust is broken, no law, army, or border can save you.

But yet, fiat breaks this contract through betrayal. It gives out the false illusion that it is neutral, but in reality, it’s an outright theft. It preaches stability, but it dissolves a man’s wage worth in silence. The labourer that works twelve hours a day, saves, and plans for his son’s apprenticeship/ University; wakes up one day in the future to use them only to find his efforts diluted by the by the invisible ink of the central banks. The tradesman balance his accounts, only to see his savings mocked by the next wave of imported labour importation and the next tsunami of printed money through price speculation. Fiat whispers “Your prudence is worthless; you time and sacrifice will not endure. Your dedicated efforts to build something, will melt!”.